Venturing into the dynamic landscape of forex trading can be both exhilarating and daunting. To navigate its intricacies effectively and enhance your chances of success, partnering with a trustworthy broker is paramount. A reputable broker provides a stable platform for executing trades, access to real-time market data, and educational get more info resources to empower you on your trading journey. They also adhere to strict regulatory standards, ensuring fair and transparent operations.

When selecting a forex broker, meticulous research is essential. Scrutinize their track record, licensing information, customer support, and trading fees. A reputable broker will clearly disclose all relevant information, allowing you to make an informed decision.

Ultimately, a strong basis built on trust and reliability is the cornerstone of successful forex trading. By partnering with a reputable broker, you can navigate the complexities of the market with confidence, maximizing your potential for profit and minimizing your risk.

Top Forex Brokers for Beginners and Experienced Traders

Navigating the volatile world of forex trading can be daunting, especially for newcomers. Whether you're just beginning your trading journey or a seasoned veteran, choosing the right broker is paramount to success. A reliable and accessible platform with favorable trading conditions can make all the variation. Fortunately, there are several reputable forex brokers available to cater to diverse trading needs and skill levels.

Here's a look at some of the leading forex brokers that have earned recognition for their trustworthiness, capabilities, and assistance:

* Broker X

* Known for its competitive fees and advanced trading platform.

* Broker B

* Offers a extensive selection of markets, including forex, commodities, and indices.

* Broker D

* Provides prompt and helpful assistance 24/7.

Remember to carefully evaluate any broker before making a commitment. Consider factors such as compliance, trading costs, platform features, and customer support reputation to find the best fit for your individual needs.

Strategies in Successful FX Results

In the dynamic world of foreign exchange trading, successful execution is paramount. It's not enough to simply identify profitable trades; you need a robust strategy to ensure your orders are filled at favorable prices and minimize slippage. This article will delve into several key strategies that can help enhance your FX execution and boost your profitability. Firstly, grasp the impact of order types. Market orders execute immediately at the best available price, while limit orders specify a target price. Choose wisely based on your risk tolerance and market conditions. Secondly, utilize sophisticated order types like stop-loss and trailing stops to manage risk effectively. These orders automatically trigger when your trade reaches a predetermined price level, helping to protect your capital from unforeseen market movements. Finally, always monitor your execution performance. Analyze fill rates, slippage, and other metrics to identify areas for improvement. By implementing these strategies and continuously refining your approach, you can significantly enhance your FX execution and pave the way for consistent profitability.

- Analyze different brokers and their trading models

- Create a clear trading plan with specific entry and exit criteria

- Simulate your strategies in a demo account before risking real capital

Unlocking Forex Trading Potential: A Guide to Success

Venturing into the world of forex trading can be exciting, presenting both challenges and lucrative opportunities. To master this dynamic market, a well-structured approach is essential. By honing your knowledge, understanding key concepts, and implementing disciplined risk practices, you can enhance your trading potential. A solid foundation in technical analysis, fundamental analysis, and market psychology will enable you to make informed decisions and prosper in the forex arena.

- Gain a comprehensive understanding of currency pairs, market indicators, and trading platforms.

- Refine a well-defined trading plan that outlines your entry and exit points, risk tolerance, and profit targets.

- Practice consistent risk management techniques to mitigate potential losses.

Continuously educate your knowledge by staying informed about market trends, economic news, and regulatory updates. Remember that forex trading requires patience, discipline, and a willingness to learn from both successes and failures.

Harnessing Technology: The Future of Forex Trading

The forex market is constantly evolving, fueled by advancements in technology. Traders are implementing these platforms to maximize their strategies. Automation is becoming momentum, allowing traders to execute trades with efficiency. Deep intelligence is also revolutionizing the forex landscape, providing data that can assist traders in making informed decisions.

- Furthermore, blockchain technology is poised to transform the forex market by enhancing transparency.

- As technology continues to progress, forex traders will have availability to an even broader range of resources to succeed in this competitive market.

Comprehending Spread and Commissions in Forex Brokerage

Navigating the world of forex brokerage may be a complex task, especially when seeking to understand key concepts like spread and commissions. The spread, essentially the gap between the bid and ask price of a currency pair, represents the earnings benefit for the broker. Meanwhile, commissions are specific costs levied per trade.

Understanding these two elements is essential to effectively overseeing your forex trading strategy. A small spread generally indicates a more liquid market, while lower commissions may reduce your overall trading costs. It's hence important to carefully compare the offerings of different brokers to discover a platform that best suits your specific trading needs and preferences.

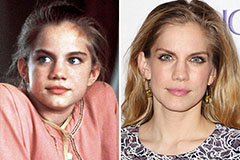

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! David Faustino Then & Now!

David Faustino Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!